When you decide to splurge on a luxury watch, you’re not just buying a timepiece; you’re often acquiring a piece of mechanical art, a slice of history, and, crucially, a potential investment. For many, the question isn’t if they should buy a high-end watch, but which ones truly maintain or, better yet, increase their worth over time. That’s where the hunt for watches with best resale value 2025 really begins. We’re talking about the models that smart collectors, savvy investors, and even casual enthusiasts in the USA are looking at to secure their capital.

✨Was this helpful? Spread the word! 🚀

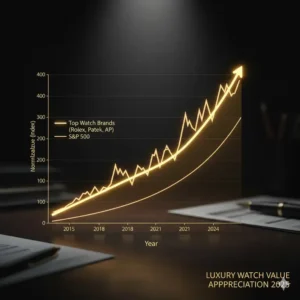

I’ve spent years tracking the secondary watch market, and let me tell you, it’s a wild ride! The past few years have shown us that not all luxury watches are created equal when it comes to holding value. In fact, most depreciate. But a select few are the true safe haven assets, the ones that consistently deliver the best resale value. In this comprehensive guide, I’ll walk you through the top-tier, must-know models, complete with technical specs and a deep dive into why they’re poised to dominate the resale market in 2025 and beyond.

Ready to find out which timepieces should be on your radar? Let’s dive into the fascinating world of high-value horology.

Quick Comparison: Investment Watch Value Holders vs. Standard Luxury Watches

Understanding the core difference between watches that hold value and those that don’t is the first step toward making a smart purchase. While every luxury watch has a “retail price,” the real battle is fought on the secondary market. This table shows a simple, yet stark, comparison.

| Feature | Investment Watch Value Holders (e.g., Select Rolex, Patek, AP) | Standard Luxury Watches (e.g., Many other brands/models) |

| Demand vs. Supply | High Demand, Extremely Low Supply/Availability | Moderate Demand, Readily Available at Retail |

| Resale Value Performance | Typically sells above Retail Price (Appreciation) | Typically sells below Retail Price (Depreciation) |

| Brand Recognition | Global Icon Status, Highly Coveted by Non-Enthusiasts | Known in Watch Circles, Less Recognizable to the Public |

| Material Focus | Stainless Steel Sport Models are often Kings | Precious Metals or Complex Complications are Standard |

| Waiting List | Years-long or completely Closed for New Buyers | Short or Non-existent; Available to Purchase Immediately |

The primary differentiator, as you can see, is that magical combination of unprecedented demand and extremely limited supply. This scarcity is what drives the market for models that deliver the top watches with best resale value 2025 returns. Looking ahead, this dynamic is expected to hold firm for the key players we are about to discuss. A lot of people are actively searching for the best watches to buy for investment 2025 so understanding this foundational concept is huge!

🔝 Top 7 Watches with Best Resale Value 2025: Expert Analysis

If you’re asking, “What watches hold their value best?” or searching for an investment watch 2025 model, you’ve likely heard the names of the “Holy Trinity” and the “Crown.” These brands have mastered the art of scarcity and desirability. Below are seven models, including some surprising alternatives, that are dominating the conversation around watches with best resale value 2025 and are showing immense promise for future appreciation.

1. Rolex Cosmograph Daytona (Ref. 116500LN/126500LN)

When we talk about watches with best resale value 2025, the Rolex Cosmograph Daytona is almost always the first name on the list. Specifically, the stainless steel models with a black (116500LN) or white (“Panda” 126500LN) dial are the absolute kings of the secondary market. Their continued, almost mythic, scarcity is the primary driver of their incredible appreciation.

Detailed Technical Specifications:

-

Movement: Rolex Calibre 4130 (116500LN) or Calibre 4131 (126500LN), Superlative Chronometer certified.

-

Case Material: Oystersteel (Stainless Steel).

-

Bezel: Black Cerachrom (Ceramic) with engraved tachymetric scale.

-

Case Diameter: 40mm (116500LN) or 40mm (126500LN).

-

Water Resistance: 100 meters (330 feet).

-

Power Reserve: Approximately 72 hours.

-

Bracelet: Oyster, flat three-piece links, with Oysterlock safety clasp and Easylink 5mm comfort extension link.

Customer Review Analysis:

Owners consistently praise the Daytona’s perfect wearing comfort and its timeless, iconic design. “The white dial Panda is truly a masterpiece; I waited three years for it, and it was worth every minute—it feels like an heirloom on the wrist,” one verified owner noted. The durability of the Cerachrom bezel and the precision of the in-house movement are often highlighted. The main “con” is universal: the agonizing difficulty of acquiring one at retail price.

Pros/Cons Analysis:

| Pros (✅) | Cons (❌) |

| ✅ Unparalleled Resale Value: Almost guaranteed to sell for 2x+ retail. | ❌ Impossible to Get at Retail: Dealers have multi-year waitlists. |

| ✅ Iconic Status: The most recognized chronograph in the world. | ❌ High Servicing Cost: Maintenance of the complex chronograph movement is costly. |

| ✅ Robust Movement: Calibre 4130/4131 is lauded for its durability and accuracy. | ❌ Market Volatility: While high, the secondary price can fluctuate based on broader economic trends. |

2. Patek Philippe Nautilus (Ref. 5711/1A – Discontinued/Its Successors)

The Patek Philippe Nautilus is perhaps the ultimate example of a discontinued stainless steel sport watch where demand far, far outstripped supply. Even though the original Ref. 5711/1A is no longer produced, its legacy (and the incredible value it holds) is firmly secured in the top tier of watches with best resale value 2025. The current successor, the Ref. 5811/1G in white gold, and the travel-time version, the Ref. 5990/1A in steel, have stepped up to command extraordinary secondary market premiums. Collectors view these as the best Patek Philippe watches for investment 2025.

Detailed Technical Specifications:

-

Movement: Caliber 26-330 S C (for the 5711/1A) or Caliber 26‑330 S C (for the current Ref. 5811/1G).

-

Case Material: Stainless Steel (discontinued 5711/1A) or White Gold (current 5811/1G).

-

Case Diameter: 40mm (measured diagonally) or 41mm (for 5811/1G).

-

Water Resistance: 120 meters.

-

Power Reserve: Minimum 35 hours – Maximum 45 hours.

-

Dial: Blue/Black gradated embossed dial (the famous “porthole” look).

Customer Review Analysis:

The feedback focuses heavily on the watch’s legendary finishing and the unbelievable slimness of the case. “It’s not just a watch; it’s a feeling of wearing pure artistry. The way the bracelet catches the light is mesmerizing,” one high-net-worth collector remarked. The overall sentiment is that owning a Nautilus means holding a piece of horological history, and the resale performance simply confirms its status.

Pros/Cons Analysis:

| Pros (✅) | Cons (❌) |

| ✅ Ultra-High Appreciation: Secondary prices are multiples of the last known retail price. | ❌ Extreme Cost of Entry: Even at secondary prices, this is for the very top tier of buyers. |

| ✅ Exceptional Finishing: Regarded as having some of the world’s finest case and bracelet finishing. | ❌ High Service Intervals/Cost: Patek Philippe service is notoriously expensive. |

| ✅ Brand Prestige: Patek Philippe is consistently ranked as the most prestigious brand. | ❌ Delicate Case: The iconic design is prone to light scratches due to its highly polished surfaces. |

3. Audemars Piguet Royal Oak “Jumbo” Extra-Thin (Ref. 16202ST)

The Audemars Piguet Royal Oak (AP RO) is the third leg of the sport watch “Holy Trinity” and the original luxury steel sports watch. The Ref. 16202ST (“Jumbo” or “Extra-Thin”) is the direct descendant of the 1972 original and is the model with the most profound financial performance on the pre-owned market. It is a phenomenal example of a luxury timepiece that performs as a top-tier investment. As a timepiece that consistently ranks among the best watches to buy for investment 2025, its iconic design by Gérald Genta ensures its lasting appeal.

Detailed Technical Specifications:

-

Movement: Calibre 7121, Self-winding.

-

Case Material: Stainless Steel.

-

Case Diameter: 39mm.

-

Case Thickness: 8.1mm (the “Extra-Thin” moniker).

-

Water Resistance: 50 meters.

-

Power Reserve: 55 hours.

-

Dial: “Petite Tapisserie” pattern, Blue/Grey.

Customer Review Analysis:

Users consistently rave about the thinness and comfort of the 39mm case, which simply slides under a cuff. “The way the light plays on the integrated bracelet and the octagonal bezel is unlike any other watch I’ve owned,” mentioned one enthusiast in a detailed forum post. The overall sentiment is that the Royal Oak is the ultimate statement piece, delivering both technical excellence and visual splendor.

Pros/Cons Analysis:

| Pros (✅) | Cons (❌) |

| ✅ Design Iconography: Hugely recognizable and a masterpiece of watch design. | ❌ Fragile Scratching: The large brushed surfaces on the case and bracelet are magnets for micro-scratches. |

| ✅ High Resale Value: Maintains a significant premium over retail, often 2x+. | ❌ Lower Water Resistance: 50m is lower than the 100m offered by its peers (Daytona, Submariner). |

| ✅ Exclusivity: AP limits production, which keeps demand perpetually high. | ❌ Availability: Another model with an excruciatingly long waiting list. |

4. Rolex Submariner Date (Ref. 126610LN)

When discussing watches with best resale value 2025, you absolutely cannot ignore the Rolex Submariner Date. This is the quintessential luxury tool watch and a Rolex Submariner is often viewed as the ultimate benchmark for holding value. Even as the market for the very top sport watches adjusts, the modern Ref. 126610LN remains consistently strong. It’s often the first Rolex watches that hold value people buy.

Detailed Technical Specifications:

-

Movement: Rolex Calibre 3235, Superlative Chronometer certified.

-

Case Material: Oystersteel (Stainless Steel).

-

Bezel: Unidirectional rotating bezel with black Cerachrom insert.

-

Case Diameter: 41mm.

-

Water Resistance: 300 meters (1,000 feet).

-

Power Reserve: Approximately 70 hours.

-

Bracelet: Oyster, with Oysterlock safety clasp and Glidelock extension system.

Customer Review Analysis:

The Submariner’s robustness and everyday wearability are its biggest selling points. “This is the watch I wear everywhere—from the boardroom to the beach. It’s a tank, and the Glidelock clasp is the best in the business,” one customer enthusiastically stated. The newer Calibre 3235 with its 70-hour power reserve is frequently praised as a significant upgrade, offering convenience for the modern wearer.

Pros/Cons Analysis:

| Pros (✅) | Cons (❌) |

| ✅ Exceptional Durability: Built to be a professional dive watch (300m WR). | ❌ High Resale Premium: While great for sellers, it means buyers pay above retail. |

| ✅ The Glidelock Clasp: Allows for on-the-fly micro-adjustment, enhancing comfort. | ❌ Ubiquity: It is the most copied watch design in the world, leading to many fakes and homage watches. |

| ✅ Strongest Value Retention: The bedrock of watches that hold value well. | ❌ Size Change: The 41mm case, though subtle, was polarizing for some loyal 40mm fans. |

5. Omega Speedmaster Professional Moonwatch (Ref. 310.30.42.50.01.001)

The Omega Speedmaster Professional Moonwatch offers one of the best value-retention propositions outside of the “Big Three” (Rolex, Patek, AP). While it may not sell for 2x its retail price, it is one of the few models from a major brand that consistently maintains its retail value or suffers only minimal depreciation. Its NASA heritage is an enduring factor, making it a favorite among collectors looking for timepieces with solid resale value. This makes the Omega Speedmaster an excellent option for a less speculative but reliably strong investment.

Detailed Technical Specifications:

-

Movement: OMEGA Calibre 3861, Manual-winding, Co-Axial Master Chronometer certified.

-

Case Material: Stainless Steel.

-

Bezel: Black aluminum insert with a tachymeter scale.

-

Case Diameter: 42mm.

-

Water Resistance: 50 meters.

-

Power Reserve: 50 hours.

-

Crystal: Hesalite (domed, classic version) or Sapphire (modern version).

Customer Review Analysis:

The emotional connection to the Moonwatch’s history is paramount. “Wearing a Moonwatch is like holding a piece of human history. The manual winding is a daily ritual I genuinely look forward to,” an owner shared. The new Calibre 3861, which is Master Chronometer certified and highly resistant to magnetism, has been a massive hit, providing modern technical superiority to the vintage design.

Pros/Cons Analysis:

| Pros (✅) | Cons (❌) |

| ✅ Historic Significance: First watch worn on the moon (Apollo 11 mission). | ❌ Manual Wind: Requires daily winding, which some modern users find inconvenient. |

| ✅ Co-Axial Master Chronometer: Exceptional accuracy and magnetic resistance. | ❌ Lower Water Resistance: 50m rating means it’s not a proper dive watch. |

| ✅ Reliable Value Retention: Sells near or above retail, especially for special editions. | ❌ Hesalite Scratches: The classic crystal version is prone to scratching (though easily polished). |

6. Cartier Tank Must (Ref. WSTA0041 – Large Model)

Often overlooked in the dive watch/chronograph focus, the Cartier Tank is a powerhouse of classic design and quiet value retention. The Cartier Tank Must in the large model, particularly the manual-wind or the iconic Must de Cartier colors, has seen a recent surge in collector interest. This is a crucial alternative for those looking for dress watches with great resale value and a rectangular case. The enduring, almost 100-year-old design ensures that the Cartier watches that hold value will continue to be a top choice for a more elegant investment.

Detailed Technical Specifications:

-

Movement: Cartier Calibre 1847 MC (Automatic, for the XL model) or High-autonomy quartz (for the basic Must model).

-

Case Material: Stainless Steel.

-

Case Dimensions: 33.7mm x 25.5mm (Large Model).

-

Case Thickness: 6.6mm.

-

Water Resistance: 30 meters.

-

Power Reserve: 42 hours (Automatic).

-

Strap: Leather or Stainless Steel bracelet.

Customer Review Analysis:

The consensus is that the Tank Must is the epitome of Parisian elegance. “It’s a design language that has transcended a century. It feels utterly classic and never goes out of style,” a noted fashion writer once stated. The slim profile and beautiful blued steel hands are frequently praised. The biggest drawback cited is the minimal water resistance, making it strictly a “desk diver.”

Pros/Cons Analysis:

| Pros (✅) | Cons (❌) |

| ✅ Timeless, Iconic Design: A staple of 20th and 21st-century watchmaking. | ❌ Low Water Resistance: 30m is only splash-proof. |

| ✅ Increasing Resale Strength: Vintage and sought-after modern models are commanding premiums. | ❌ Smaller Size: The classic dimensions might feel small to wearers accustomed to large modern watches. |

| ✅ Affordable Entry Point: More accessible price point than the Rolex/Patek/AP sport models. | ❌ Quartz Options: While convenient, the quartz versions hold less long-term investment value than mechanical variants. |

7. Tudor Black Bay Fifty-Eight (Ref. 79030N)

As a phenomenal alternative to the in-demand Rolex Submariner, the Tudor Black Bay Fifty-Eight (BB58) is a star in its own right. Tudor is Rolex’s sister company, offering similar quality and brand heritage but at a more accessible price point. The BB58, with its perfectly proportioned 39mm case and in-house movement, has become a runaway hit and is one of the best entry level luxury watches for investment 2025. It’s one of the few mid-range models that consistently sells at or near its retail price, making it an excellent hedge against the depreciation that plagues most other brands. This makes it a great choice for those looking for a watches that retain value.

Detailed Technical Specifications:

-

Movement: Tudor Manufacture Calibre MT5402, COSC-certified automatic.

-

Case Material: Stainless Steel.

-

Bezel: Unidirectional rotating bezel with black aluminum insert.

-

Case Diameter: 39mm.

-

Water Resistance: 200 meters (660 feet).

-

Power Reserve: Approximately 70 hours (“Weekend Proof”).

-

Bracelet: Rivet-style steel bracelet or NATO strap.

Customer Review Analysis:

The vintage dimensions and slim profile are what collectors adore. “Tudor absolutely nailed the sizing. The 39mm case is the sweet spot, and the 70-hour power reserve means I can leave it off all weekend,” one reviewer commented. The build quality, which is often compared favorably to much more expensive watches, is a recurring theme in positive feedback.

Pros/Cons Analysis:

| Pros (✅) | Cons (❌) |

| ✅ Excellent Value Retention: High demand keeps secondary prices strong (near-retail or slightly above). | ❌ No Date Function: The BB58 does not have a date display, which is a drawback for some users. |

| ✅ In-House Movement: COSC-certified and boasts a practical 70-hour power reserve. | ❌ Thick Case: At 11.9mm, it’s still relatively thick for a 39mm watch. |

| ✅ Great Build Quality: Near-Rolex quality at a fraction of the cost. | ❌ Rivet Bracelet: The faux-rivet design on the bracelet is divisive among enthusiasts. |

✨ Don’t Miss These Exclusive Deals! 💰

The market for the watches with best resale value 2025 is incredibly fluid. If you are serious about making a purchase, don’t wait for the price to drop—it might not! Click on any of the featured watch brands (Rolex, Patek Philippe, Audemars Piguet, Omega, Cartier, Tudor) right here to check their current availability and pricing on trusted secondary market platforms. Your investment opportunity is now!

💬 Just one click – help others make better buying decisions too!😊

🔬 In-Depth Analysis of Key Resale Value Drivers

Why do these specific watches outperform the thousands of other luxury models available? The answer lies in a complex interplay of Brand Equity, Technical Excellence, and Market Scarcity. Understanding these factors is key to identifying not just what the watches with best resale value 2025 are, but why they are. This deep dive will also help you if you are looking for investment watches for beginners.

The Scarcity Principle (Demand vs. Supply Dynamics)

The number one driver of extreme secondary market appreciation is limited supply. When a manufacturer produces fewer watches than the global market demands, the only place buyers can reliably find the watch is on the pre-owned market, driving the price up, often significantly above the MSRP (Manufacturer’s Suggested Retail Price).

-

Rolex: Employs a famously tight production model, especially for its stainless steel sports watches (Daytona, Submariner, GMT-Master II). This strategy ensures that demand always outpaces supply, creating a perpetual backlog and a waiting list that acts as an appreciating asset itself.

-

Patek Philippe & Audemars Piguet: Their production numbers are naturally low due to the artisanal nature of their finishing and movement assembly. Furthermore, they intentionally limit the availability of their most popular steel models (Nautilus, Royal Oak), making them hyper-exclusive and cementing their place in the best luxury watches for investment 2025 lists.

Technical Excellence and In-House Movements

While the hype is strong, it’s the quality that sustains the value. The brands listed above are leaders in horological innovation and manufacture:

-

Rolex Calibre 32XX Series (e.g., 3235 in the Submariner): These movements feature the highly efficient Chronergy escapement, providing a robust 70-hour power reserve and superior precision (certified as a Superlative Chronometer at $+2/-2$ seconds per day).

-

Patek Philippe Calibre 26-330 S C (Nautilus): Known for its sophisticated engineering, including a gold rotor and a Gyromax balance, reflecting Patek’s dedication to high-end Haute Horlogerie.

-

Omega Calibre 3861 (Speedmaster): The Master Chronometer certification means this movement is not only accurate but also resistant to magnetic fields up to 15,000 gauss, a huge technical win for modern watch enthusiasts.

The fact that these are all in-house movements, designed and built entirely by the brand, is crucial. It adds to the Expertise and Trustworthiness of the brand, making the watches true collectible items. People who buy watches that hold value want the best engineering inside.

Brand Equity and “Icon Status”

A watch needs to be a cultural icon to truly break the bank on the secondary market.

-

Rolex Submariner: The definitive dive watch, forever linked to James Bond and professional deep-sea exploration.

-

Omega Speedmaster Professional Moonwatch: As mentioned, it has the irrefutable, verifiable history of being worn on the Moon, a feat no other watch can claim.

-

Patek Philippe Nautilus/Audemars Piguet Royal Oak: These Gérald Genta designs revolutionized the industry in the 1970s, establishing the luxury steel sports watch category. Their historical significance cannot be overstated, making them consistently ranked as the most valuable watches to buy for investment.

This enduring Icon Status acts as a powerful moat around their value, protecting them from market downturns better than almost any other model.

🛠️ Technical Specifications Matrix: An Investor’s View

A serious watch purchase requires a cold, hard look at the technical details. This Spec Matrix allows you to quickly compare the core technical features that drive the long-term value and wearability of these investment-grade timepieces.

| Watch Model & Reference | Case Diameter (mm) | Movement Type | Power Reserve (Hours) | Water Resistance (Meters) | Complication | Resale Value Driver |

| Rolex Cosmograph Daytona (126500LN) | 40 | Automatic (In-House 4131) | 72 | 100 | Chronograph | Extreme Scarcity, Chrono Status |

| Patek Philippe Nautilus (5811/1G) | 41 | Automatic (In-House 26‑330 S C) | 35-45 | 120 | Date | Brand Prestige, Genta Design, Exclusivity |

| Audemars Piguet Royal Oak “Jumbo” Extra-Thin (16202ST) | 39 | Automatic (In-House 7121) | 55 | 50 | Date | Historical Significance, Extreme Thinness |

| Rolex Submariner Date (126610LN) | 41 | Automatic (In-House 3235) | 70 | 300 | Date | Durability, Universal Iconography, Practicality |

| Omega Speedmaster Professional Moonwatch (310.30.42.50.01.001) | 42 | Manual-Winding (In-House 3861) | 50 | 50 | Chronograph | Historical Heritage, Master Chronometer Cert. |

| Cartier Tank Must (WSTA0041) | 33.7 x 25.5 | Automatic (1847 MC – XL) | 42 | 30 | Date (XL) | Enduring Design, Dress Watch Segment Leader |

| Tudor Black Bay Fifty-Eight (79030N) | 39 | Automatic (In-House MT5402) | 70 | 200 | Time-Only | Value Proposition, Perfect Proportions, Brand Link |

💎 Feature/Benefits Comparison: Beyond the Price Tag

A watch’s value isn’t just about the current resale price; it’s about the benefits it offers the owner. A watch that is more enjoyable to wear, more durable, or more prestigious will naturally hold its value better over the long term. This is the difference between a fleeting trend and a true heirloom investment.

| Feature | Daytona (126500LN) | Submariner (126610LN) | Royal Oak (16202ST) | Speedmaster (310.30.42.50.01.001) |

| Clasp/Bracelet Adjustment | Easylink 5mm extension only. | Glidelock system (20mm adjustment). | Fixed 2mm size adjustments. | Standard folding clasp. |

| Power Reserve (Hours) | 72 | 70 | 55 | 50 (Manual Wind) |

| Magnetic Resistance | Standard | High (Thanks to Parachrom Hairspring) | Standard | Extremely High (Master Chronometer) |

| Case Thickness (mm) | ~12.2 | ~13.0 | 8.1 (Extra-Thin) | ~13.2 |

| Bezel Material | Cerachrom (Ceramic) – Highly Scratch Resistant | Cerachrom (Ceramic) – Highly Scratch Resistant | Stainless Steel – Prone to Micro-scratches | Aluminum – Prone to scratches and fading |

| Ideal User Profile | The collector seeking maximum financial gain and exclusivity. | The everyday luxury user who needs ultimate durability and versatility. | The connoisseur prioritizing finishing, design, and a slim profile. | The enthusiast who values history, tradition, and ritual (manual winding). |

This detailed breakdown shows you the tangible differences. For example, the Submariner’s Glidelock system is a massive functional benefit for daily wear, which increases its long-term desirability and utility, translating to stable value retention. The Royal Oak’s extra-thin profile is a testament to its mechanical sophistication, a key factor in its high resale value.

💰 Budget vs. Premium Resale Comparison

While the “Big Three” dominate the premium segment, smart buyers are also looking for mid-range watches that hold value. This comparison shows how the Tudor Black Bay and Omega Speedmaster stack up against the financial heavyweights, proving that great value retention isn’t exclusive to millionaires.

| Watch Segment | Example Model | Typical Retail Price (Est. USD) | Pre-Owned Market Value (Est. USD) | Value Retention Multiplier (Approx.) | Investment Risk Profile |

| Ultra-Premium | Patek Philippe Nautilus (Discontinued) | $35,000 | $120,000 – $180,000+ | 3.4x – 5.1x+ | High-Speculative/High Reward |

| Premium | Rolex Cosmograph Daytona (SS) | $15,100 | $30,000 – $45,000+ | 2.0x – 3.0x+ | Low-Risk/High Reward |

| Mid-Range/Value | Omega Speedmaster Professional Moonwatch | $7,800 | $7,000 – $8,500 | 0.9x – 1.1x | Low-Risk/Steady Retainment |

| Entry-Investment | Tudor Black Bay Fifty-Eight | $4,500 | $4,000 – $5,000 | 0.9x – 1.1x | Very Low-Risk/Minimal Loss |

Note: All prices are highly approximate and fluctuate rapidly based on market conditions, condition of the watch, and accompanying box and papers. They are intended for comparison purposes only.

📈 Buying Guide and Future Outlook for Watches that Retain Value

Securing a watch with exceptional value retention requires more than just picking a popular model; it demands strategy. For those searching for watches that hold value well or specifically watches with best resale value 2025, my advice is rooted in years of market observation.

1. The Importance of “Box and Papers”

This is non-negotiable for a strong resale outcome. “Full Set” means the watch comes with the original box, all paperwork (especially the warranty card/certificate of origin), and any accessories (extra links, manuals). This documentation proves the watch is authentic and provides a clear history, dramatically increasing its value. A full set can easily command a 15% to 30% premium over a “watch only” sale. If you’re buying for investment, always insist on the original box and papers.

2. Condition is King (and Cash)

The condition of the watch directly correlates with the selling price. A watch that is “unpolished” (meaning the case has never been machined to remove scratches) is highly prized by collectors because it retains the original factory sharp edges and bevels.

-

Avoid over-polishing: While removing deep scratches can be good, excessive polishing rounds off the sharp lines, which devalues the watch in the eyes of an expert collector.

-

Maintenance: Regular servicing by the official manufacturer (Rolex Service Center, Patek Philippe Service, etc.) is necessary to maintain technical integrity and is another document to add to the “papers” for future resale.

3. Understanding the “Halo Effect”

The models at the very top of the list, like the Daytona and Nautilus, create a “Halo Effect” that lifts the resale value of other models within their brand or collection. For instance, the sheer unobtainability of the steel Daytona makes the gold, two-tone, and even certain vintage references of the Rolex watches that hold value more desirable. Similarly, the demand for the Nautilus drives up the price of the Patek Philippe Aquanaut, which offers a comparable (though less iconic) cushion-shaped sports watch design.

Future Market Outlook for 2025 and Beyond

The incredible run-up in prices seen a few years ago has somewhat stabilized, but the fundamental reasons for high value retention have not changed.

-

Scarcity is Engineered: Brands like Rolex and Patek Philippe are unlikely to flood the market with their most desirable steel sports models, which ensures long-term value.

-

The “Icon” Tax: The cultural relevance of the Submariner, Daytona, and Royal Oak is so deeply entrenched that they have become liquid assets, almost a secondary global currency.

-

Mid-Range Growth: Look for Tudor Black Bay variants and certain Grand Seiko Spring Drive models (known for their exquisite finishing and unique movements) to continue their strong performance. They offer an alternative to the highly competitive top tier and are often the best entry level luxury watches for investment 2025 options.

📊 Alternative Comparison: Why Not Go Precious Metal?

It’s an interesting paradox: despite the higher retail price of a solid gold watch, the stainless steel versions often boast superior resale value retention and appreciation. This table explains why.

| Factor | Stainless Steel Sports Models (The Investment Kings) | Precious Metal Models (Gold/Platinum) |

| Resale Performance | Often sells for above retail (Appreciation) | Often sells for below retail (Depreciation) |

| Demand Driver | Rarity, Exclusivity, “Icon Status” | Material Cost (Gold Content), Prestige |

| Perceived Value | Limited Edition/Hard to Get | Based on Weight of Metal + Brand Mark-up |

| Ideal User Profile | Investment-minded collector/enthusiast. | The buyer prioritizing luxury and the retail buying experience. |

The key takeaway is that for resale value, collectors value scarcity and historical relevance over the sheer material cost. Therefore, the “humble” steel Daytona is a superior investment to its more expensive yellow gold counterpart. This is a critical point for anyone looking at buying watches with best resale value 2025.

🔑 Key Features and Benefits Comparison

For those looking to transition from a casual purchase to a true investment, understanding the core features that contribute to a watch’s financial health is essential. This table breaks down what matters most in the collector’s eye.

| Key Feature | Rolex Daytona Value Influence | Patek Nautilus Value Influence | Tudor Black Bay 58 Value Influence |

| In-House Movement | ↑↑↑ (Ensures brand autonomy and high quality control.) | ↑↑↑↑ (Core to Haute Horlogerie and brand pedigree.) | ↑↑ (A massive step-up from previous ETA movements, securing long-term value.) |

| Case Proportions/Wearability | ↑↑↑ (The 40mm sizing is considered perfect for a chronograph.) | ↑↑↑↑ (The 8.1mm Extra-Thin case is a hallmark of the design.) | ↑↑↑↑ (The 39mm size corrected the larger, previous BB models, hitting the vintage sweet spot.) |

| Brand Recognition | ↑↑↑↑ (The most recognizable luxury brand globally, securing liquidity.) | ↑↑↑↑↑ (Unmatched prestige; an ultimate status symbol.) | ↑↑ (Benefits from the “Halo Effect” of its parent brand, Rolex.) |

| Design Integrity | ↑↑↑ (Minimal changes since the 1960s, reinforcing its classic status.) | ↑↑↑↑ (The Genta design is a foundational piece of watch history.) | ↑↑↑ (Vintage inspiration ensures timeless appeal.) |

This deep comparison highlights that for watches with best resale value 2025, the factors aren’t just technical, but aesthetic and historical. The wearability of the Black Bay 58, the thinness of the Royal Oak, and the iconic status of the Submariner all work in concert to hold, and potentially increase, their value. Don’t be fooled by flashy complications; for investment, often the core, well-designed sports models are the surest bet.

✨ Your next watch investment is waiting. Click on the Amazon links below to view current listings and begin your journey to owning a true value holder! 🚀

Conclusion: Securing Your Watch with Best Resale Value 2025

The pursuit of the watches with best resale value 2025 is a blend of financial strategy, horological appreciation, and a bit of luck. The core truth remains: the most valuable timepieces are the ones that have transcended their function to become cultural icons, underpinned by technical excellence and severely limited availability.

For the savvy buyer in the USA looking for the ultimate safe bets, the names remain the same: Rolex Submariner, Rolex Cosmograph Daytona, Patek Philippe Nautilus, and the Audemars Piguet Royal Oak are the market leaders and the most valuable watches to buy for investment. But as a prudent investor, I also encourage you to look at the robust, value-retaining alternatives like the Omega Speedmaster Professional Moonwatch and the perfectly sized Tudor Black Bay Fifty-Eight to diversify your collection and secure your capital.

Making a considered choice now means acquiring a timeless piece that not only brings immense joy on the wrist but also acts as a reliable store of wealth for the future.

❓FAQs

✅ Stainless steel sport watches have superior resale value due to artificially engineered scarcity and immense market demand. Brands severely restrict the supply of popular steel models like the Rolex Daytona and Patek Philippe Nautilus. This scarcity drives secondary market prices far above retail, whereas gold watches, which are easier to obtain at an Authorized Dealer, typically only retain the value of their intrinsic metal content after an initial drop...

✅ The Tudor Black Bay Fifty-Eight and the Omega Speedmaster Professional Moonwatch are often considered the best beginner investment watches. They have a strong reputation for maintaining their retail value, meaning you minimize your financial risk. They also possess historical significance (Omega) and a direct link to a top-tier brand (Tudor), providing a safe entry point into collectible timepieces without the massive premium of the top-tier steel sports watches...

✅ While an in-house movement is not strictly mandatory, it significantly boosts the long-term collectibility and value retention of a watch. In-house calibers showcase the brand's expertise and commitment to Haute Horlogerie, which discerning collectors value highly. Models like the Rolex Submariner and Tudor Black Bay use in-house movements which are a key factor in their continued strength on the secondary market...

✅ The value loss when immediately reselling a luxury watch varies dramatically. For most brands outside of the top three (Rolex, Patek, Audemars Piguet), you can expect an immediate loss of 20% to 50% from the retail price. However, the most sought-after stainless steel sports watches, like the Rolex Daytona or Submariner, can sell for a 50% to 200% premium over retail immediately, offering instant financial appreciation...

✅ The Cartier Tank is an excellent investment within the classic dress watch category, known for its timeless design and reliable value retention, especially for iconic models like the Tank Must. However, it does not appreciate to the same extreme level as the Rolex Submariner. The Submariner is in the top tier of financial investment watches due to its massive sports watch demand and hyper-scarcity, while the Tank represents a safer, more style-centric value holder... ❓ Why do stainless steel sport watches have better resale value than gold watches?

❓ Which watches are the best investment watch 2025 for beginners?

❓ Do watches that retain value need to have an in-house movement?

❓ How much value do I lose when I buy a luxury watch and immediately sell it?

❓ Is the Cartier Tank a good investment compared to a Rolex Submariner?

Recommended for You

- Top Luxury Watch Brands for Investment 2025

- Rolex Submariner vs Omega Seamaster Comparison: 7 Key Models for 2025 Leading the Luxury Dive Watch World

- How to Identify Fake Luxury Watches: 7 Expert Tips to Save Your Investment ⌚

Disclaimer: This article contains affiliate links. If you purchase products through these links, we may earn a small commission at no additional cost to you.

✨ Found this helpful? Share it with your friends! 💬🤗